American Express Platinum Review: Luxury Isn't Cheap

Table Of Content

For instance, if you haven't visited the CardMatch site recently, now's an excellent time to check your CardMatch offers. Some users are targeted for 125,000-point or 150,000-point offers on The Platinum Card from American Express ($695 annual fee, see rates and fees). Yes, the Amex Platinum has more lounge access than the Chase Sapphire Reserve®. The Reserve comes with same-day flight access to Priority Pass Select lounges upon enrollment. Forbes Advisor uses data from various government agencies to determine baseline income and spending averages across various categories, which we used to compile rewards potential for various credit cards. The 70th percentile of wage-earning households brings in $116,000 annually and has $36,177 in annual expenses that could be reasonably charged to a credit card.

Amex Platinum welcome offer

She is passionate about helping people leverage credit cards to achieve their travel goals. Her work has appeared in numerous publications, including Bankrate, Business Insider, CNN Underscored, Forbes Advisor and Lonely Planet. The Platinum Card® from American Express has a “frequent flyer” written all over it. Jetsetters will benefit the most from this card because of the bonus purchase rewards for airfare and also for additional perks. Even though it isn’t a co-branded airline credit card, it is still considered one of the best airline cards.

How does this card – and the new welcome offer – compare to the competition?

While the Amex Gold Card pairs well with the Amex Platinum, it has its drawbacks. The $250 annual fee may be a deterrent for those who already feel the sting of the Amex Platinum’s $695 annual fee. If you’re looking for a more affordable alternative that still checks many of the same boxes, here are some other cards to consider. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. When booking a rental car with Amex, cardholders can receive complimentary upgrades with most major rental car companies.

Award vs. cash calculator

Note that this is significantly below TPG's valuation of Membership Rewards points at 2 cents each, but if you find yourself racking up points faster than you can spend them, this can be a worthwhile option. The American Express Platinum Card for Schwab is only available to Charles Schwab customers. There's no way around this requirement since you must sign into your Schwab account during the application process. The Schwab investor checking account reimburses all ATM fees worldwide, making this a great option for getting cash when traveling. However, suppose you also have The Business Platinum Card® from American Express.

Up to $100 to Cover the Application Fee for Global Entry or TSA PreCheck

Her top priority is providing unbiased, in-depth personal finance content to ensure readers are well-equipped with knowledge when making financial decisions. Because my oldest child squeezes every dollar like Scrooge McDuck, I was curious when he began using The Platinum Card® from American Express, because of its hefty annual fee (see rates and fees). Still, it took me a year or two to investigate what he saw in it. Once I did, I applied for a card of my own and haven't looked back. When booking your reservation through either network, you must hit the “Pay Now” button instead of paying later to receive the statement credits. Another thing to keep in mind is that this bonus is a “once-in-a-lifetime opportunity.” Some credit cards will allow you to claim welcome bonuses multiple times usually by waiting at least 2 years since the credit card was closed.

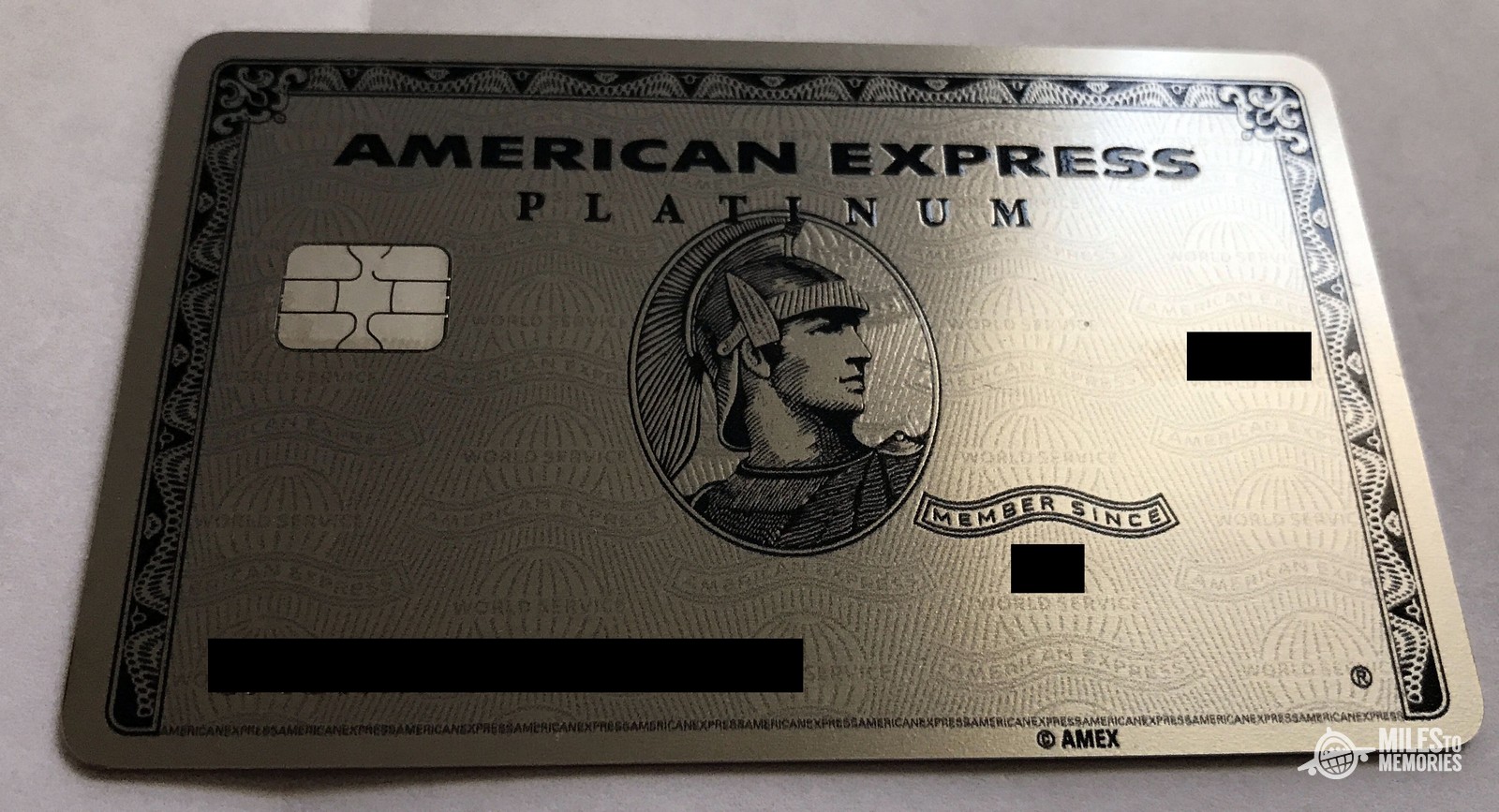

It also includes the new Capital One Venture X Rewards Credit Card which, among many other benefits, offers 2x Capital One Venture Miles for every dollar you spend on the card. Last month, American Express unveiled two new designs on its Platinum Card® from American Express premium credit card. Today, those new designs are now available – for both new and existing cardmembers. Learn how the American Express Platinum Card advances the promise of everyday adventure with its lavish assortment of travel-focused benefits, credits, and perks. Terms apply to all benefits listed below and all offers are subject to change.

Hotel Reward Programs

It’s also a good idea to keep an eye on whether publicly available limited-time offers like this one come with a stated expiration date. If so, you could elect to wait until closer to this date to see if a better offer will populate for you. However, this approach could be risky as popular offers have occasionally been pulled early. It’s always a good idea to explore whether you can get equal or more value for less spending if you are targeted for a better offer. These targeted offers can come via email or through the mail, or you may be able to find pre-qualified offers on the Amex website.

OTHER ACCOUNTS AND PAYMENTS

Uber Eats orders, plus a bonus $20 in December (enrollment is required). However, this Uber Cash will only be deposited into one Uber account when you add the Amex Platinum as a payment method. To use it in an authorized user's Uber account, you must delete the card from the original account and reenroll using your authorized user's account. Another great perk that also extends to additional Amex Platinum cardholders is the statement credit for Global Entry (up to $100) or TSA PreCheck ($78) application fees. Just like the benefit provided to primary cardholders, each authorized user can use this benefit once every four years for Global Entry or once every 4.5 years for TSA PreCheck.

Emergency medical transportation assistance may be provided at no cost only if approved and coordinated by Premium Global Assist Hotline. Card Members may be responsible for the costs charged by third-party service providers. No matter where you're traveling, there are no foreign transaction fees when you use your Card. Get tickets to see some of your favorite artists, learn from experts, or unlock exclusive behind-the-scenes content—all from the comfort of your couch. With Preferred Access, you have access to premium seats for select cultural and sporting events, based on availability.

No doubt about it, the travel rewards are the best feature of The Platinum Card® from American Express, making it one of the best rewards cards. But, cardholders also receive one reward point for every dollar spent on card purchases. For travel itineraries purchased through Amex Travel, cardholders will receive two points for every $1 spent. Additionally, cardholders can get a 35% airline bonus when using their points to pay for all or part of a flight with a qualifying airline booked on amextravel.com, up to 500,000 bonus points annually. By far the most difficult American Express Platinum benefit to putting a value on, the concierge service gives cardholders access to a certain program that can help them make purchases or make arrangements for all kinds of needs or wants. It’s basically a special phone service that functions as an outsourcing facility for the cardholders’ to-do lists, especially with regard to the things that they spend money on.

Many of the credit card offers that appear on this site are from credit card companies from which we receive financial compensation. This compensation may impact how and where products appear on this site (including, for example, the order in which they appear). However, the credit card information that we publish has been written and evaluated by experts who know these products inside out.

If you're an Equinox+ member and you use The Platinum Card® from American Express to purchase a SoulCycle at-home bike, you'll receive a $300 statement credit. The rewards are solid and the perks are outstanding, but the annual fee can't be ignored. The other reason businesses should be excited about this card is the 50% point bonus on purchases of $5,000 or more. The best way to use this would be on a large travel purchase made with American Express Travel, so your 50% bonus would be on top of the 5x bonus category. Check the CardMatch tool to see if you're targeted for a 150,000-point Platinum Card offer (after meeting minimum spending requirements). From my experience, 9 out of 10 times, you should never redeem Membership Rewards points for flights through American Express Travel, as you will get much better value utilizing transfer partners.

Amex Platinum authorized users can also take advantage of complimentary Gold status with Marriott Bonvoy and Hilton Honors. Both the primary cardholder and authorized users should be able to enroll for these statuses online. If you frequent Marriott or Hilton properties, this can bring you room upgrades, bonus points and additional on-property perks. However, unlike some other premium travel cards, there's an additional cost to adding authorized users on the Amex Platinum — and as noted previously, this is now higher. The Centurion® Card from American Express, known as the American Express Black Card, is considered higher than the Amex Platinum.

Amex Platinum Card Review 2024 - Business Insider

Amex Platinum Card Review 2024.

Posted: Fri, 15 Mar 2024 07:00:00 GMT [source]

For example, I value some benefits, like the Saks Fifth Avenue credit and the airline incidental fee credit at about 50% to 75% of their total value, because I wouldn’t prepay full price for those things. I assign no value to things like the Walmart+ credit and the Equinox credit because I don’t use them at all. Although Amex has added new Platinum perks and raised the card's annual fee, they aren't eliminating or changing the card's existing benefits. If your score isn't quite where it needs to be yet, read our guides on improving your credit score and how using credit cards can help boost your score. The card doesn't charge foreign transaction fees, but it does have the Amex Pay Over Time financing option (rather than paying your statement balance in full each month), See Pay Over Time APR to see your rates. Many of the best cards have no annual fee, but here's why the Amex Platinum's fee might be worth it for you.

Although the annual fee is high, if you are able to take advantage of all of the perks, you can easily offset that fee. With your Platinum Card, you’ll receive $15 in Uber Cash for U.S. rides with Uber and orders with Uber Eats every month in the U.S., plus a $20 bonus in December, delivered straight through an exclusive Uber app experience. An Equinox+ membership is required to purchase a SoulCycle at-home bike and access SoulCycle content. With Lounge Finder, you can locate and check into nearby airport lounges based on your location. To gain entry, simply use the Amex®️ App to display a QR code within Mobile Check-In. For rates and fees of The Platinum Card® from American Express, click here.For rates and fees of The Business Platinum Card® from American Express, click here.

Comments

Post a Comment